Optimism #86 - April 7, 2025

Dear clients and friends,

I am hearing that there is still a bit of Spam coming from my email address … or appearing to.

I am sorry for however this came to be.

Our tech people have looked at it and it’s not coming from us. Please be vigilant.

I will never send you “pictures from my weekend in Paris”. I think that is what the last one said.

Market corrections are strange and unsettling. Stock prices drop, people get worried, and I understand. This is our life savings.

I have a higher-than-average ability to ignore my emotions. Not the best husband but it serves me well in tumultuous times.

Stock prices correcting is a bit like a stranger knocking on our door and offering less than the home is worth.

Would I accept it? No. Would it bother me? It shouldn’t but yes.

It’s an offer, not a true estimate of value, from a complete stranger. And we don’t have to accept it, in fact we would be foolish to do so.

Our answer should be ‘no thank you’ and ‘don’t let the door hit you on the way out.’ And that should be the end of it.

But is not. News is inherently negative. And some of us take the offer.

The important point is to ignore the noise and be clear about the difference between price and value.

Charlie Munger always said “…price is what you pay, value is what you get.”

It’s like my analogy of bananas. They were 89 cents a pound last week, 49 cents this week. That is the price. What is the value?

I see ‘green shoots’. I think this was the buzz line of optimism after the 2008 stock and housing market massacre began to improve.

In bad times, money moves to bonds and defensive stocks, like utilities, like my Fortis.

For the last few weeks Fortis has been rising, but today its falling, telling me two things.

ETF (exchange traded & index fund) and mutual fund holders are still selling and the ETFs own Fortis.

Second, my guess is that professional money managers are selling Fortis to buy banks, energy, technology and other stuff that has been really beaten up.

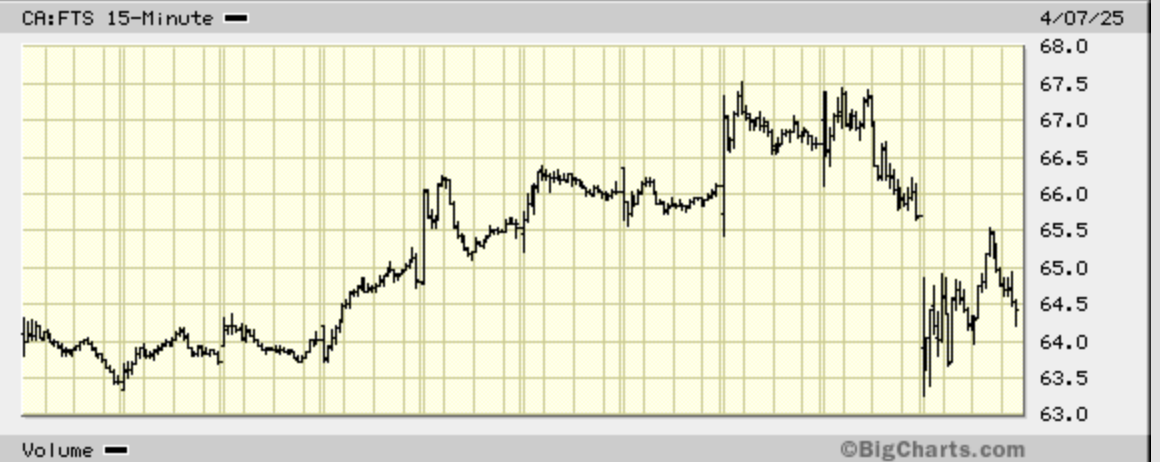

Here is a Fortis (FTS) chart of the last ten days. Pretty flat. You can see the price rise from 63$ to over $67 quite quickly – then dip back to around $63.

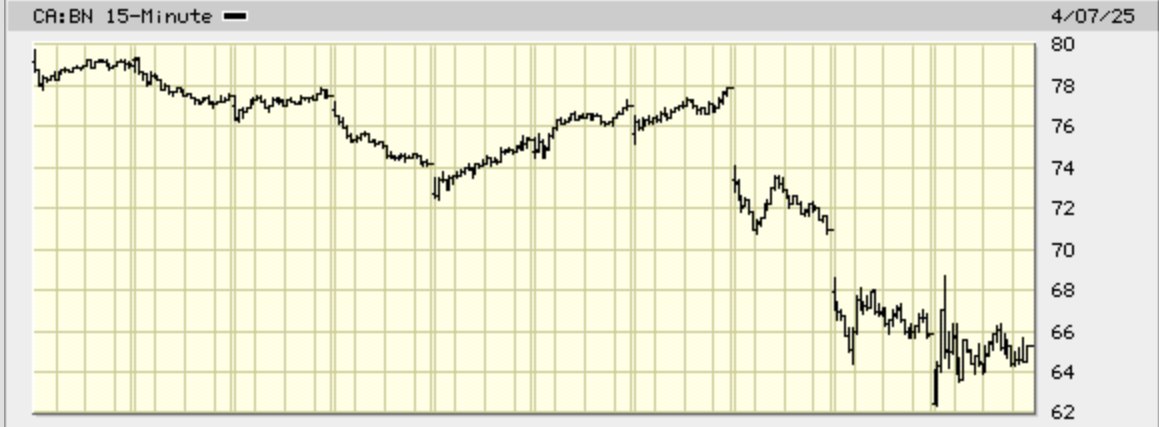

Compare that to Brookfield for example:

It was around 80$ and now around 65$, down about 19%.

I try to tune out the news, remind myself of our high-quality holdings and predictable dividend income, and get back to what is important.

And that offer to sell your home for far less than its worth... a simple no thanks.

This discussion reminds of a guy I used to know a guy named Ron. He managed the local small town TV station. CHBC News it was called. Ron was an absolute prince.

He told me about trying to start a good news television channel. The idea never got off the ground. No one was interested. Life is ironic.

If looking for a book idea, I am reading Beating the Midas Curse, about how family wealth usually disappears after 3 generations and how the ones that outlast handle it differently.

Happy Spring. Let’s chat if you have questions.

Derek Moran