Optimism #74 - June 6, 2024

Dear clients and friends,The bad news is my most recent Fortis Gas bill. $159.34 for $24.08 of natural gas.

What would I do without dividends?

The good news is … look at all of these dividend increases in May 2024 alone. (I cut and pasted this from the Canadian Dividend All-Star List):

Loblaw Companies Limited (TSE:L): 15.0% Dividend Increase [Streak: 12 years, Yield: 1.3%]

George Weston Ltd (TSE:WN): 15.0% Dividend Increase [Dividend Streak: 12 years, Yield: 1.7%]

Altius Minerals Corporation (TSE:ALS): 12.5% Dividend Increase [ Streak: 6 years, Yield: 1.6%]

Finning International (TSE:FTT): 10.0% Dividend Increase [Dividend Streak: 22 years, Yield: 2.7%]

Hydro One Limited (TSE:H): 6.0% Dividend Increase [Dividend Streak: 8 years, Yield: 3.2%]

TMX Group Limited (TSE:X): 5.6% Dividend Increase [Dividend Streak: 8 years, Yield: 2.1%]

Sunlife (TSE:SLF): 3.8% Dividend Increase [Dividend Streak: 9 years, Yield: 4.7%]

National Bank of Canada (TSE:NA): 3.8% Dividend Increase [Dividend Streak: 14 years, Yield: 3.8%]

Telus Corporation (TSE:T): 3.5% Dividend Increase [Dividend Streak: 20 years, Yield: 6.9%]

Canadian Western Bank (TSE:CWB): 2.9% Dividend Increase [Dividend Streak: 32 years, Yield: 5.5%]

Royal Bank of Canada (TSE:RY): 2.9% Dividend Increase [Dividend Streak: 13 years, Yield: 3.8%]

Osisko Gold Royalties Ltd (TSE:OR): 8.3% Dividend Increase [Dividend Streak: 3 years, Yield: 1.1%]

Equitable Group Inc. (TSE:EQB): 7.1% Dividend Increase [Dividend Streak: 2 years, Yield: 2.1%]

Russel Metals Inc. (TSE:RUS): 5.0% Dividend Increase [Dividend Streak: 1 years, Yield: 4.6%]

Pembina Pipeline (TSE:PPL): 3.4% Dividend Increase [Dividend Streak: 2 years, Yield: 5.5%]

Caribbean Utilities Company Ltd. (TSE:CUP.U): 2.9% Dividend Increase [Streak: 1 years, Yield: 7.0%]

Bank of Montreal (TSE:BMO): 2.6% Dividend Increase [Dividend Streak: 2 years, Yield: 5.1%]

In the late 1990s I met ‘C.P.’ a retired fellow and he had an enormous influence on me. He owned ten thousand shares of all of the Canadian banks, utilities, telcos, pipelines, some energy and retail.

He came to the mutual fund company I worked at, looking for free financial planning ideas. I had few clients and was on floor duty.

You would never look twice at him, yet his holdings generated copious dividends. He drove a car I would describe as ‘unremarkable’, especially relative to his net worth and income.

Now I drive an unremarkable pick-up truck and have lots of dividends. The humor is not lost on me.

At the time tech stocks were all the rage. They were referred to as the ‘new economy’. Our banks and utilities were considered old and on their way to the graveyard.

I have circled roughly when that was happening. Look at what happened since then. Including dividends, Royal Bank has probably returned 25x.

Patience. Canadian dividend stocks will shine again.

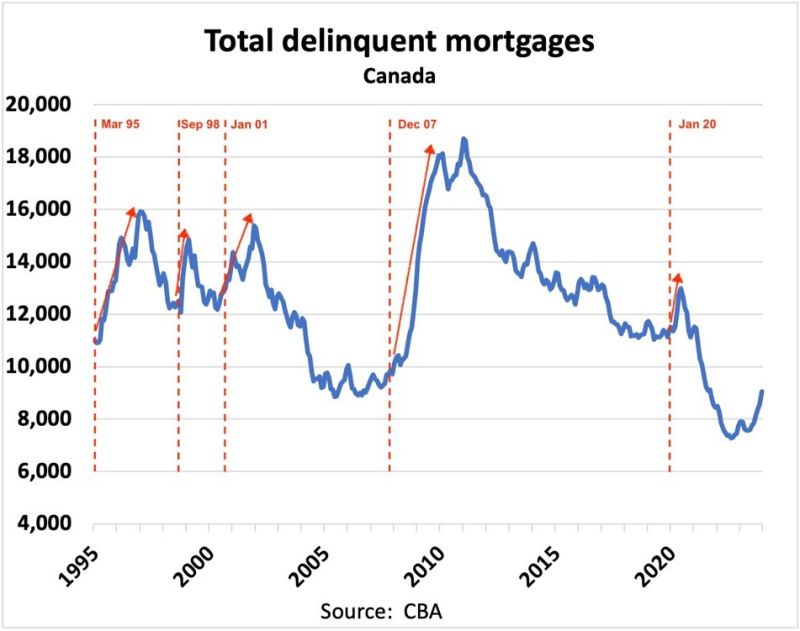

If you are planning on buying or selling real estate in the next two or three years, you should have a good look at this chart. Historically, the economy often falters after interest rates start to fall.

Thanks for the chart to Ben Rabidoux on Twitter (X).

Enjoy the rest of the week.

Derek Moran