Optimism #77 - August 14, 2024

Dear clients and friends,

July is normally boring in investing. Usually, the people with massive influence are at the lake, away from their screens. This year not so.

I suspect that you will be pleased with your end of July statements.

Attached is a link to a terrific article by Tom Bradley about how investing is not like the Olympics. Here is my favourite line:

‘Burgundy Asset Management’s Anne Mette de Place Filippini recently reinforced this thought with a quote from the white rabbit in Alice in Wonderland. “Don’t just do something, stand there.” You don’t have to make changes just because the stock market is bouncing up and down and you’re getting pounded by a fire hose of information. Most often, the best action is no action.’

When your statement values are up is a good time to reflect on asset allocation. Does it continue to reflect your time horizon and risk tolerance?

There are a few dividend increases: Capital Power +6%, StorageVault Canada +.5%, and CT Real Estate Investment Trust +3%.

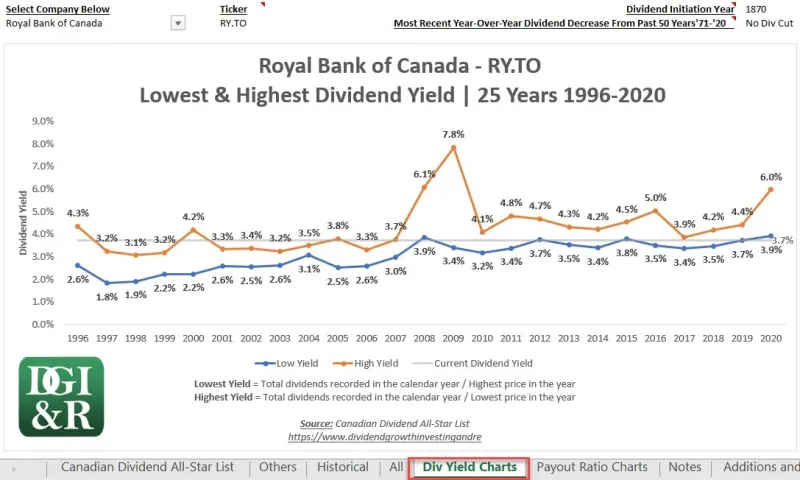

I copied this chart from the Canadian Dividend All-Star List site. It’s a great reminder to consider buying more shares of top-quality companies when yields are higher than normal. Their example is Royal Bank (RBC). When yields are up, prices are down and often there is a buying opportunity. A high yield can be a sign of trouble as well, so proceed with caution. We can see that yields peaked during corrections, most noteworthy are 2009 and Covid, 2020.

Enjoy the rest of the summer. We will be reaching out in mid September to book October and November reviews.

Derek Moran